Italian Tech Week marks a key inflection point for the tech ecosystem every year. For three days in Turin founders, investors and policymakers came together to review a sector that has matured dramatically over the last decade, yet still facing crucial structural challenges. The tone was consistent, from startup operators to EU leaders: Italy is no longer a newcomer to the innovation economy. The next phase must be about scale.

This article provides a strategic overview of the most significant themes and issues that emerged during the event. It is a 'so what?' piece designed to equip founders and VCs with actionable insights and a sense of direction.

Among the headline names at Italian Tech Week 2025, Jeff Bezos and Ursula von der Leyen offered contrasting - but unexpectedly aligned - messages.

Bezos closed the event with a mix of trademark optimism and subtle warning. “There has never been a better time to be an entrepreneur” he said, just before calling AI “a kind of industrial bubble”. Mission-driven founders, he argued, are best positioned to navigate this volatility. In moments of rapid change and uncertainty, startups have an inherent advantage.

Von der Leyen, speaking from Brussels, struck a similar tone: Europe must become a place where “the best of Europe chooses Europe”. That vision will require more than inspiration: it demands new legal frameworks, better capital markets, and a strategic approach to AI.

One takeaway echoed across both speeches: optimism is not just a mindset — it’s infrastructure.

A cornerstone of Italian Tech Week is Yoram Wijngaarde annual data briefing. The founder of Dealroom.co once again provided a clear picture of the Italian startup ecosystem and its ongoing challenges.

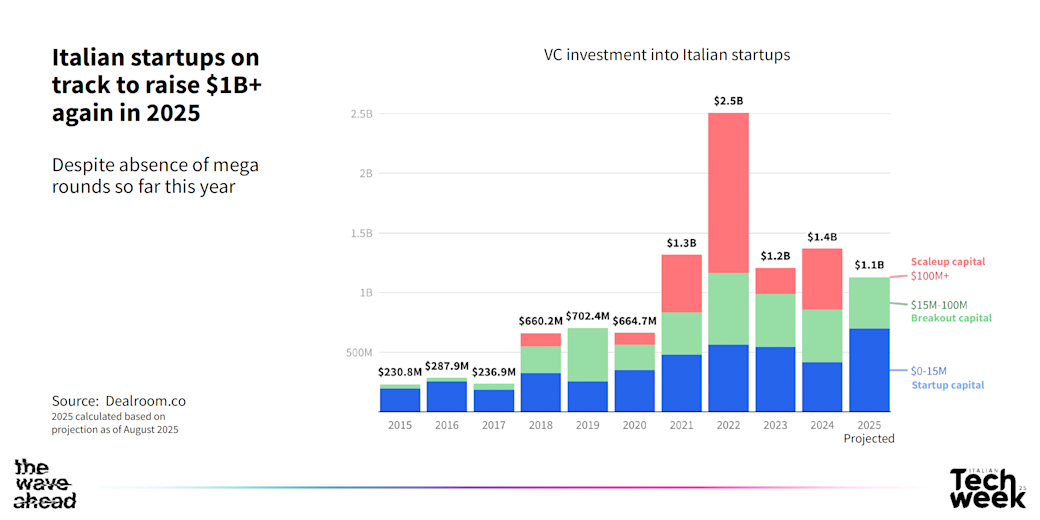

According to Dealroom, total VC funding in Italy is projected to reach around €1 billion in 2025 - a figure that has remained stable for the past five years despite macroeconomic fluctuations. Notably, the year is set to close without a single mega-round above €100 million, indicating ongoing difficulty in scaling beyond early and mid-stage growth.

Nevertheless, structural progress is evident:

VC funding is projected to reach €1 billion in 2025, in line with the previous five years - a sign of resilience, but also stagnation in terms of scale despite absence of mega rounds so far this year (FIG.1).

Italy is seeing increased activity in deep tech, climate tech, and biotech, especially at the seed and Series A level.

A growing number of new founders have previously worked at unicorns or growth-stage startups - a trend known as the alumni effect. It brings sharper execution, stronger networks, and an ambition shaped by scale-up experience.

FIG. 1 - The state of VC in Italy 2025 - a research by Dealroom.co

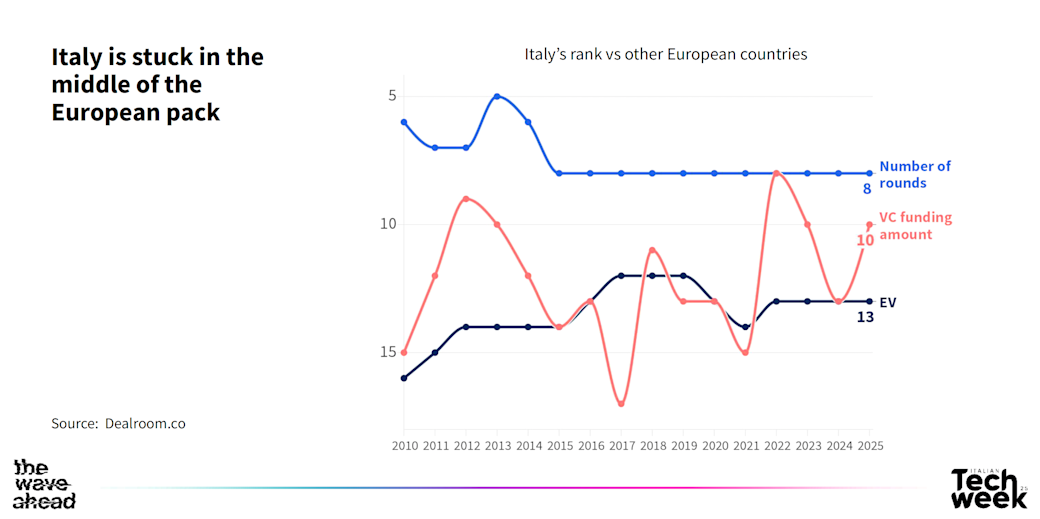

FIG. 1 - The state of VC in Italy 2025 - a research by Dealroom.coHowever, the weaknesses are equally evident. The Series A graduation rate remains at 18%, which is significantly below the European average of 24% (FIG. 2). Italian startups tend to focus on the domestic market, with teams that are predominantly local, and access to capital remains largely national - limiting exposure to international funds and partnerships.

In short, the Italian ecosystem is healthy at its core, but it still lacks the structural conditions required to achieve scale at the top.

FIG. 2 - The state of VC in Italy 2025 - A research by Dealroom.co

FIG. 2 - The state of VC in Italy 2025 - A research by Dealroom.coOne of the most forward-looking conversations at Italian Tech Week came from beyond the national ecosystem, from Brussels. Ursula von der Leyen set out a three-pronged strategy to promote large-scale innovation: improved access to capital, greater market integration and an AI-first industrial policy.

At the heart of this agenda lies EU Inc., a newly proposed legal framework that could transform how European startups are formed and scaled. Also referred to as the '28th regime', EU Inc. would enable founders to incorporate once and operate across all member states, bypassing the legal fragmentation that has long hindered cross-border growth.

Von der Leyen also announced the upcoming Scale-up Europe Fund, which is designed to address the equity gap in late-stage financing. Unlike existing instruments, this fund will target strategic sectors such as AI, cleantech, and deep tech — areas in which European innovation is promising but lacking in capital.

While not all of these instruments are fully in place yet, the direction is clear. Europe is moving to remove long-standing legal, financial and geographic barriers to growth. For founders, the priority is to stay informed, anticipate the shift and align future strategies with this evolving landscape.

A good place to start? Support the initiative by signing the EU Inc. petition — and make your voice heard in shaping a truly scalable European tech market.

If there was one topic that cut across every panel at Italian Tech Week 2025, it was artificial intelligence. It was not discussed in the abstract, but as a tangible shift in how products are built, how businesses operate and how users engage with technology.

The examples were concrete. OpenAI’s Pulse, a real-time, context-aware interface, and Sora, its video generation engine, signaled a shift from reactive tools to anticipatory, immersive AI experiences. These are not just productivity boosters - they are reshaping user expectations from the ground up.

For Italian founders, the implications are immediate. Whether they are building for logistics, manufacturing, health or finance, the question is no longer whether AI should be included, but what their product will become when AI is the starting point rather than an add-on.

Because, in 2025, AI will not be an upgrade. It’s infrastructure.

Italian Tech Week 2025 confirmed what many in the tech ecosystem already suspected: Italy is no longer laying the foundations for its tech sector - it now needs to confront the challenge of scaling up to avoid stagnation. The infrastructure is emerging, talent is becoming more visible, and ambitions are growing. However, without structural breakthroughs, the system risks becoming self-referential.

Based on the data and insights gathered during the week, a clear picture emerges: Venture capital volumes are stagnating, internationalization is limited, and the transition from a startup to a scale-up remains the exception rather than the norm. While promising sectors such as AI, climate tech and deep tech are emerging, they often lack the financial and regulatory support needed to thrive.

What is needed now is not just more capital, but smarter capital — funding that rewards long-term investments, international expansion, and complex innovation. Beyond capital, Italy also needs greater strategic permeability: to talent, to markets, and to partnerships that extend beyond its borders — a goal that initiatives like EU Inc. and the upcoming Scale-up Europe Fund aim to support at the continental level. Italy, with its structural fragmentation and domestic capital reliance, stands to benefit more than most from these European efforts.

This is not a pessimistic view. On the contrary, the conditions for progress are emerging. However, they will only be effective if founders, investors and institutions act with clarity, scale with intention and learn to distinguish between activity and progress.