The startup landscape in 2024 is characterized by a rebuilding of investments, a pronounced focus on Europe as an entrepreneurial hub, evolving dynamics in big tech interactions, and the continued centrality of AI as a transformative force. Entrepreneurs and investors alike are encouraged to closely monitor these trends, seizing the emerging opportunities presented by this reshaped and revitalized startup ecosystem.

We should consider 6 important trends:

The global startup ecosystem is poised for a revival in 2024 as it rebounds from the challenges of a significant downturn in 2023. The aftermath of the global reset has set the stage for a nuanced investment landscape. While 2023 witnessed a contraction in investment levels, signs of recovery are emerging, presenting startups with renewed funding opportunities. Investors are likely to scrutinize business models meticulously, favoring those that exhibit resilience, sustainability, and the potential for robust growth.

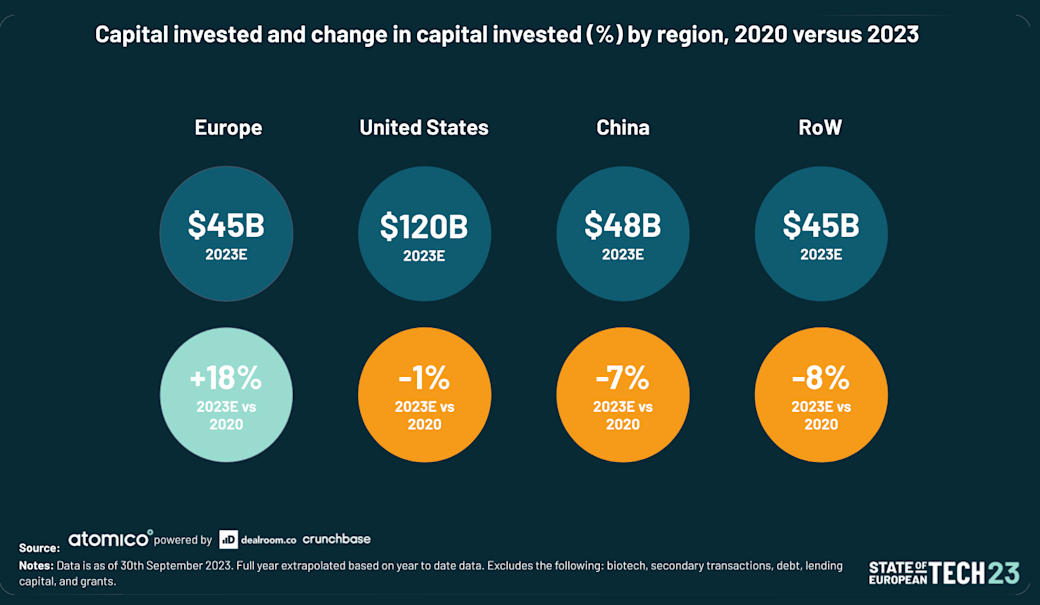

Amidst the global investment slowdown, Europe emerges as a standout region, signaling a robust focus on entrepreneurship and innovation. Over the past five years, Europe has consistently outpaced the United States in the creation of new tech startups. Despite a challenging period that wiped $400 billion in value, the European tech ecosystem has demonstrated remarkable resilience, bouncing back to an impressive $3 trillion valuation. This positions Europe at the forefront of the startup resurgence, offering a fertile ground for emerging ventures.

Artificial Intelligence (AI) continues to hold a central role in the startup resurgence. Despite challenges faced in 2023, AI remains a driving force, offering innovation and transformative potential. Notably, Generative AI, a subset making waves in Europe, is expected to contribute significantly to workflows, regulatory discourse, and societal advancements. Startups leveraging AI technologies can expect heightened attention and investment, with a focus on breakthroughs, particularly in multi-million dollar rounds. The integration of AI into various sectors positions it as a catalyst for shaping the future of the tech landscape in 2024.

As we enter 2024, it's clear that Environmental, Social, and Governance (ESG) activities are set to become integral to corporate strategy. Businesses will embrace ESG as an opportunity for fundamental transformation, marking a pivotal year for corporate sustainability.

Here are six impactful predictions for ESG in the coming year (according to Thomson Reuters):

ESG in Finance: Sustainability will be woven into financial practices, with CFOs and finance professionals prioritizing ESG integration for sustained value.

Private Firms Embrace ESG: Sustainability reporting will expand to private firms due to Scope 3* rules, driving transformations across industries.

ESG's Political Landscape: ESG discussions will remain politically charged, requiring companies to navigate carefully during elections and employ strategies to mitigate polarization.

Biodiversity in Focus: Biodiversity loss will gain prominence as a mainstream ESG topic in 2024, with global goals and increased investment in biodiversity.

Supply Chains Driving E&S Priorities: Mandates for Scope 3 reporting will push companies to prioritize ethical sourcing and fair labor standards across supply chains.

Greenwashing Scrutiny: Greenwashing will face increased scrutiny, with legal frameworks aiming to define and penalize deceptive sustainability practices.

The startup landscape is intricately linked with the dynamics of big tech, and 2024 witnesses a notable shift in the IPO and M&A activity. Following six quarters of subdued exit events, the third quarter of 2023 marked a resurgence with significant IPOs, including ARM's (British multinational semiconductor and software design company) $55 billion debut. This 're-opening' of the IPO window and other billion-dollar public offerings indicate a potential revival in the exit landscape. The role played by big tech in shaping market trends will be instrumental, influencing the trajectory of startups and their interactions with established industry players.

While a return of some IPOs is anticipated in 2024, a roaring comeback for new listings seems unlikely. Public-market investors are becoming more selective, prioritizing profitability over unchecked growth. Larger, more established companies with sustained market capitalization are likely to garner more attention. Some companies may choose to delay IPOs until 2025 or later, presenting challenges for the vast number of private companies with valuations of $1 billion or more.

As we navigate the evolving landscape of tech and venture in 2024, these trends provide a glimpse into the challenges and opportunities that lie ahead. Stay tuned on our Newsletter and Linkedin channel for more news in the world of technology.

Source: state of European Tech

Source: https://news.crunchbase.com/venture/trends-tech-startups-ai-ipo-forecast-2024/

Source: https://www.thomsonreuters. com/en-us/posts/esg/esg-predictions-2024/

*Scope 3 encompasses emissions that are not produced by the company itself and are not the result of activities from assets owned or controlled by them, but by those that it's indirectly responsible for up and down its value chain.