Angel investors — private individuals who invest their own capital — can play a critical role in the development of early-stage startups. Unlike larger institutional funds, angels provide support during the earliest phases of a company’s development, although in some cases, their role may extends into later funding rounds. Their involvement frequently begins during the formative stages, when a business is refining its product and exploring market validation, complementing capital with mentorship and early access to networks.

As stated by Paola Bonomo, Vice Chair of Italian Angels for Growth, during the event Investing in startups: opportunities and risks of angel investing, organized by B4i:

“At the pre-seed stage, you’re not investing in a business. You’re investing in a team, an intention. A certain type of energy.”

Angel investing is both a financial commitment and a relational endeavor — a partnership based on trust, vision alignment, and mentorship.

Experienced angels emphasize that the founder’s profile often outweighs the product’s initial concept in early-stage decisions. There are several recurring qualities that every angel should look for in a founder before committing capital:

Execution capacity over invention: an inventor is not an entrepreneur. Startups built solely on an untested idea, without a capable team to execute, often fail to scale. Investors assess whether founders demonstrate operational discipline, not just creativity.

Complementary skill sets: teams composed of “photocopy co-founders” — individuals with identical backgrounds — are a red flag. Angels favor teams with diverse, complementary expertise.

Realistic growth mindset: startups projecting hypergrowth without acknowledging operational constraints risk credibility. Angels appreciate founders who balance ambition with pragmatism, as reflected in funding strategies that blend minimum viable funding and customer revenue.

Mental resilience: given Italy’s lower seed-to-Series A graduation rate (18%, versus the European average of 24%), angels look for entrepreneurs prepared for the volatility of early-stage ventures.

But there is another critical aspect to consider, as Paola Bonomo emphasizes: “Successful angels avoid "lifestyle businesses" disguised as scale-ups, i.e. companies that plateau at modest profitability and lack potential for an exit or transformative impact”.

From the perspective of founders, the decision to bring an angel investor on board is rarely about capital alone. The most successful founder-angel partnerships are grounded in a combination of strategic alignment and personal rapport. Founders should prioritize several key attributes:

Strategic mentorship: many angels are seasoned entrepreneurs or executives with the experience to guide early-stage companies through pivotal decisions. Their advice and perspective can help founders navigate challenges that go well beyond funding.

Access to networks: a well-connected angel can open doors to early customers, potential partners, and future investors, accelerating market entry and validation.

Flexible, founder-centric approach: compared to institutional investors, angels often adopt a more adaptive stance, tailoring their level of involvement to the needs and maturity of the business.

Alignment of vision and values: founders seek angels who share a long-term outlook and are committed to supporting sustainable growth, rather than pushing for a rapid exit at any cost.

Credibility and signaling power: the reputation of an experienced angel can validate a startup in the eyes of other stakeholders, making it easier to attract additional capital and talent.

Angel investing is characterized by a very specific risk-return profile: the majority of early-stage investments do not return the original capital. According to the US industry group Angel Capital Association, between 50% and 70% of deals either fail entirely or only recover part of the initial investment (source). However, the overall success of an angel portfolio depends on a small percentage of so-called “big winners.” In fact, the top 10% of the most successful investments typically generate up to 85–90% of total returns (source).

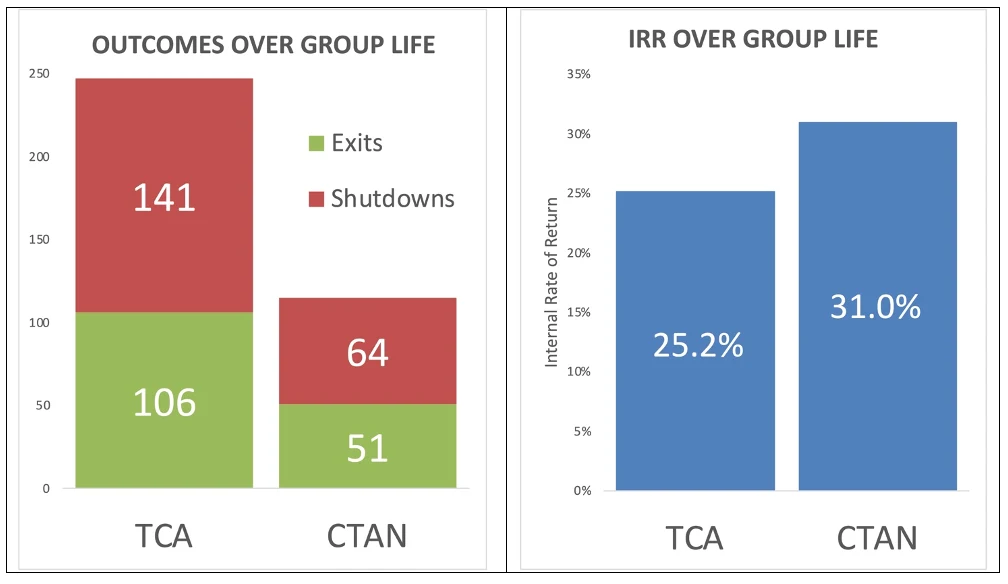

On average, angel investors in the United States have achieve a return of approximately 2.6 times their invested capital over a time horizon of about 3.5 years (source), with an internal rate of return (IRR) ranging between 25% and 31% (see figure below). These figures are only possible thanks to a handful of exceptional outcomes that offset the many inevitable losses.

Angels returns

Angels returnsSource: 247 Tech Coast Angels outcomes from 1997-2022; 115 Central Texas Angel Network outcomes from 2006-2022.

For startups this means they must aim for rapid, scalable growth to join that small group of success stories capable of creating meaningful value for investors. For angels, on the other hand, diversification across multiple startups is essential to increase the likelihood of capturing one of these “home runs” and justify the inherent risk of early-stage investing.

While these figures illustrate the financial realities of angel investing, it is important to remember that strong economic outcomes are often the result of trusted relationships, shared vision, and strategic support. In other words, the “people business” dimension is not just a cultural factor — it is what ultimately drives returns. Unlike passive investments, angel investing requires time, judgment, and a willingness to engage with founders as a strategic partner. Ultimately, angel investing is a people business. As Bonomo notes, “The angel must be an anchor of common sense, sometimes a coach, and always a partner who never invades the founders’ operating space.” However, not every partnership succeeds. A lack of trust, diverging expectations, or misaligned ambitions can easily derail progress and, in some cases, compromise the viability of the entire venture. For founders and aspiring angel investors alike, approaching this relationship with clarity, respect, and shared purpose can be the foundation of extraordinary entrepreneurial journeys.

---

At B4i, we are launching a new Alumni Bocconi Angel Club with the goal of strengthening the B4i ecosystem, which continues to expand its range of tools to support startups at the right stage of their growth. This initiative brings together individuals who can offer both capital and expertise, following a smart money/equity approach. Are you a Bocconi alumnus interested in joining? Discover more and fill out the form here.